An open letter to first-time PE-backed CEOs on boardrooms, blind spots and learning faster than you think you can.

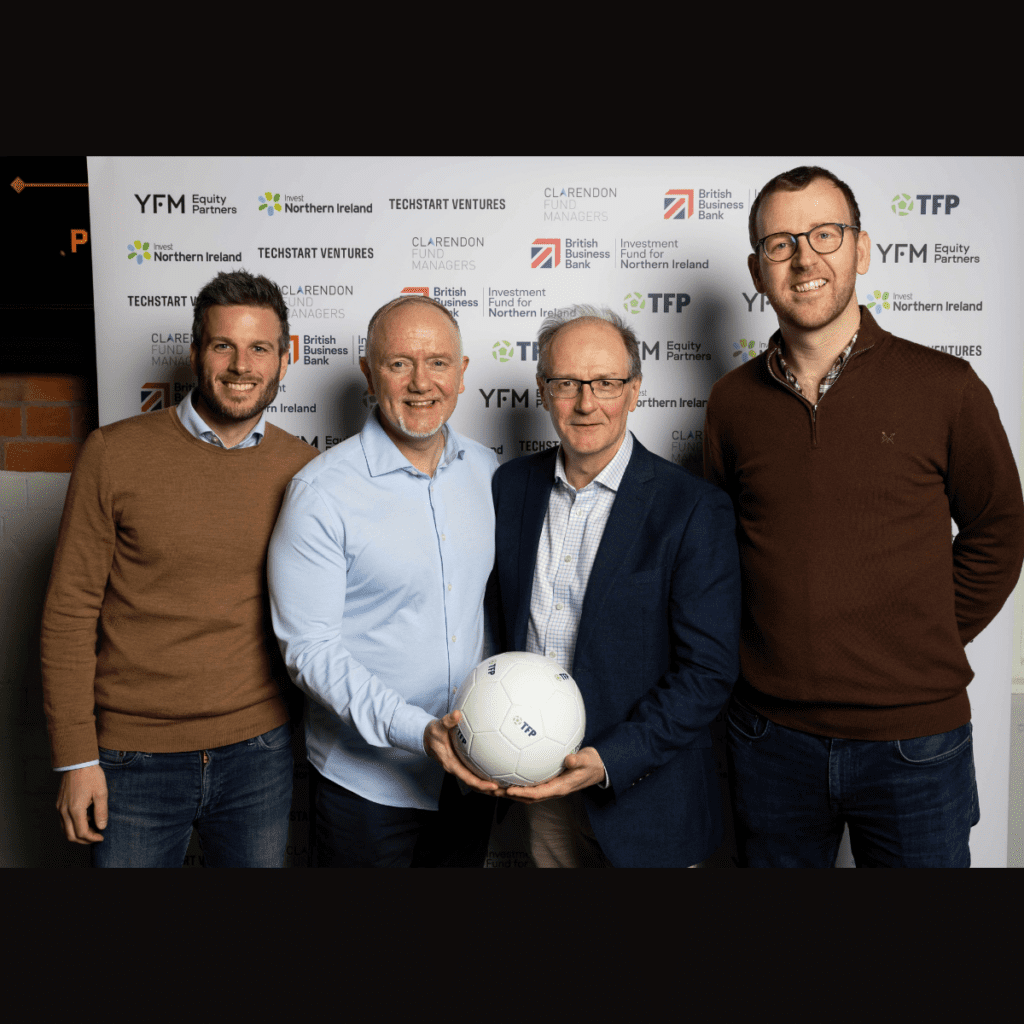

YFM Equity Partners help ambitious UK small businesses scale up, accelerate growth, and fund ownership transitions with flexible equity solutions.