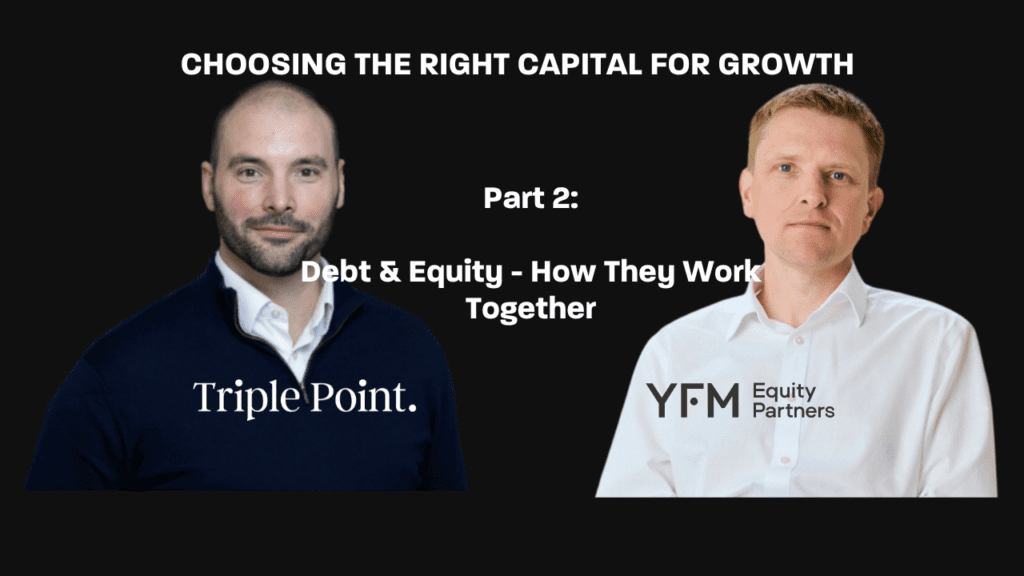

How should founders decide between debt and equity? In part two of YFM and Triple Point’s Funding to Grow series, Jamie Roberts and Dominic Reason explore when each approach works best and why blending both is often the smartest route to sustainable growth

YFM Equity Partners help ambitious UK small businesses scale up, accelerate growth, and fund ownership transitions with flexible equity solutions.