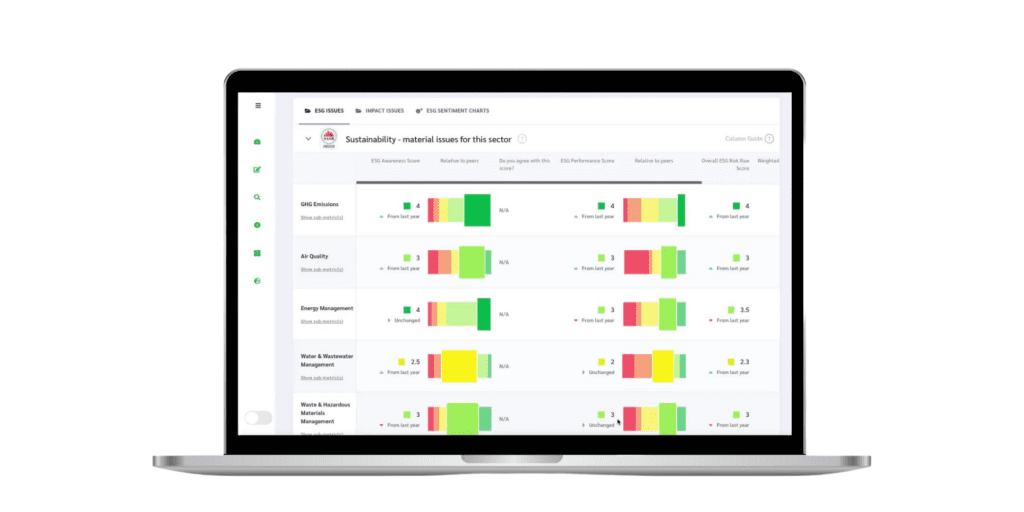

YFM’s investment in StormHarvester supports its AI-driven technology, helping water companies prevent pollution and flooding by detecting leaks and blockages in sewage networks. With increasing regulatory and public pressure, StormHarvester’s innovative solutions are transforming water management for a more sustainable future.

Fuel Your Business Growth

At YFM Equity Partners, we provide equity growth capital funding to help ambitious UK small businesses scale faster, expand into new markets, and accelerate their next stage of growth. Whether you are investing in product development, building your team, or expanding your operation, YFM can provide the capital and support you need.