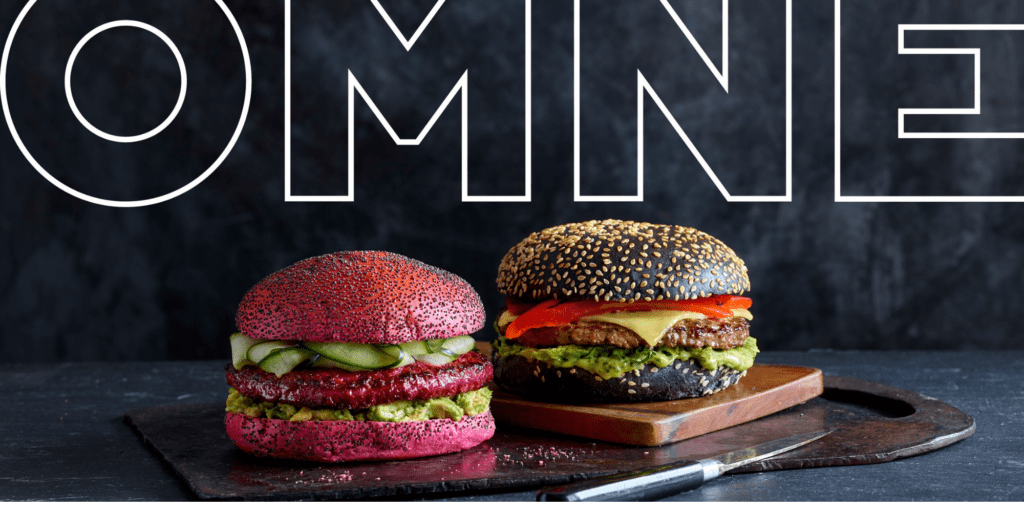

YFM’s investment in Omne supports its growth as a leading B2B marketing agency in the food, beverage, and hospitality sectors. With deep industry expertise, Omne helps big brands strengthen stakeholder relationships and expand their market presence in a rapidly growing global industry.

At YFM Equity Partners, we are committed to empowering the next generation of entrepreneurs in the South West of England, helping ambitious businesses unlock their full potential through tailored private equity, growth capital, and management buyout solutions.

The South West is home to a diverse range of thriving industries, from Bristol’s burgeoning technology and creative sectors to Exeter’s growing financial services and Plymouth’s advanced manufacturing hubs. Entrepreneurial cities like Bath and Swindon continue to attract investment and talent, reinforcing the region’s reputation as a centre for innovation and enterprise.

With a strong foundation of world-class universities, a highly skilled workforce, and a collaborative business ecosystem, the South West offers significant opportunities for business owners and advisors seeking growth.

At YFM, our regional focus ensures we understand the local landscape, helping businesses scale and succeed while creating long-term value for investors, companies, and the wider economy.

We are proud to support the South West’s entrepreneurs and businesses, contributing to the region’s continued economic success.