Explore how YFM is backing sustainable, high-growth businesses in our newly released 2024 Responsible Investment Report. From record-breaking investments to hands-on ESG support, find out how we’re helping portfolio companies tackle carbon, culture and cyber – and why responsible investing is good for business and the planet.

Portfolio News

How carbon measurement can give portfolio companies a commercial edge: Following our latest carbon webinar with Positive Planet, we explore how credible emissions data is helping YFM-backed businesses stand out in tenders, cut costs, and future-proof for growth – and why it’s a key part of the value we bring to our portfolio.

We’re excited to back S4labour with £4 million of growth capital. Their smart SaaS platform is helping hospitality operators manage teams more efficiently, profitably, and intelligently.

YFM has backed the management buyout of The Networking People (TNP) — a Lancaster-headquartered provider of network technology, connectivity and cyber security services. TNP delivers secure, high-performance infrastructure for public sector organisations across the UK, including local government, healthcare and emergency services.

YFM Equity Partners has made a further investment into WorkBuzz, the employee engagement platform helping organisations build more connected, productive workplaces. The funding will support WorkBuzz’s continued growth, AI innovation and international expansion, as the business scales its impact and ambitions.

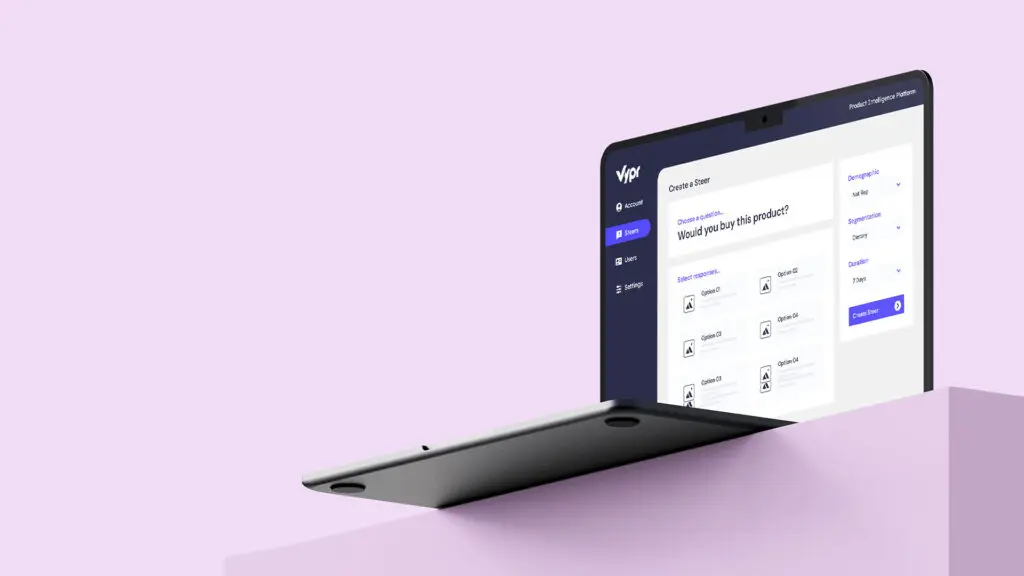

YFM Equity Partners has made a further investment into Vypr, the product intelligence platform helping brands and retailers make better product decisions. The funding will support Vypr’s international expansion and the launch of its next-generation platform, as the business builds on its strong growth and global ambitions.

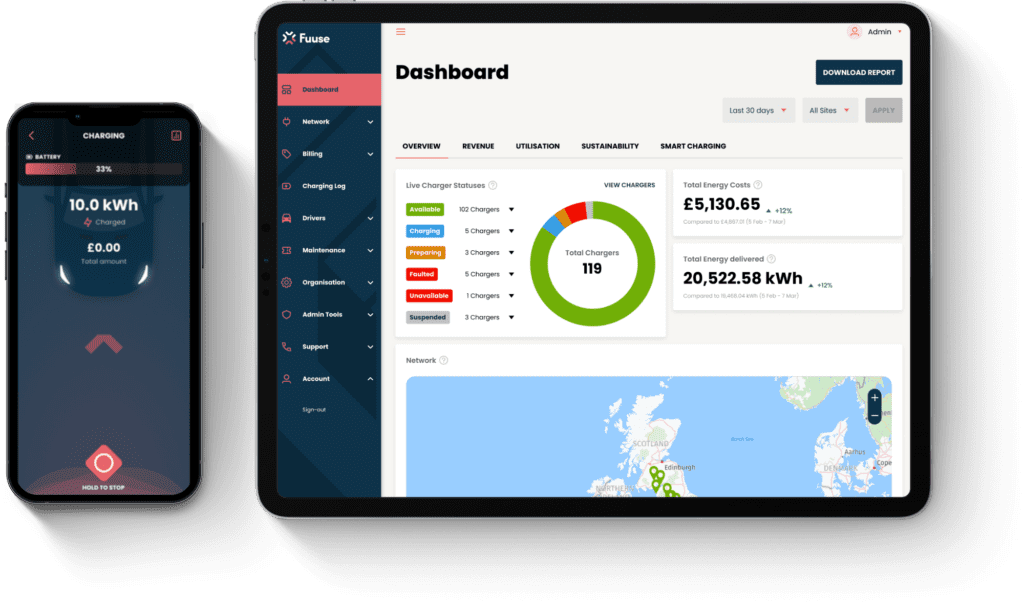

As the shift to electric vehicles (EVs) gains momentum, the need for intelligent and efficient charging infrastructure has never been greater. Fuuse, a pioneer in charge point management software, is revolutionising EV charging by enhancing accessibility, optimising energy use, and supporting the seamless adoption of sustainable transport solutions.