YFM appoints Jamie Roberts as Managing Partner, with Eamon Nolan transitioning to Head of Investor Relations & Fundraising. This leadership evolution supports YFM’s continued growth and strategic focus, building on strong 2025 momentum and a clear vision for the future.

YFM News

We’re excited to announce that Tom Phillips has joined YFM Equity Partners as our new Investor Relations Director. With over 18 years’ experience across financial services, Tom will focus on strengthening relationships with our valued investors and supporting our continued growth.

Find out how we repurpose our old work laptops to support refugees and vulnerable communities. Instead of discarding them, we securely wipe, refurbish, and donate these devices to charities, helping individuals access education, employment, and vital connections. A simple step, making a lasting impact.

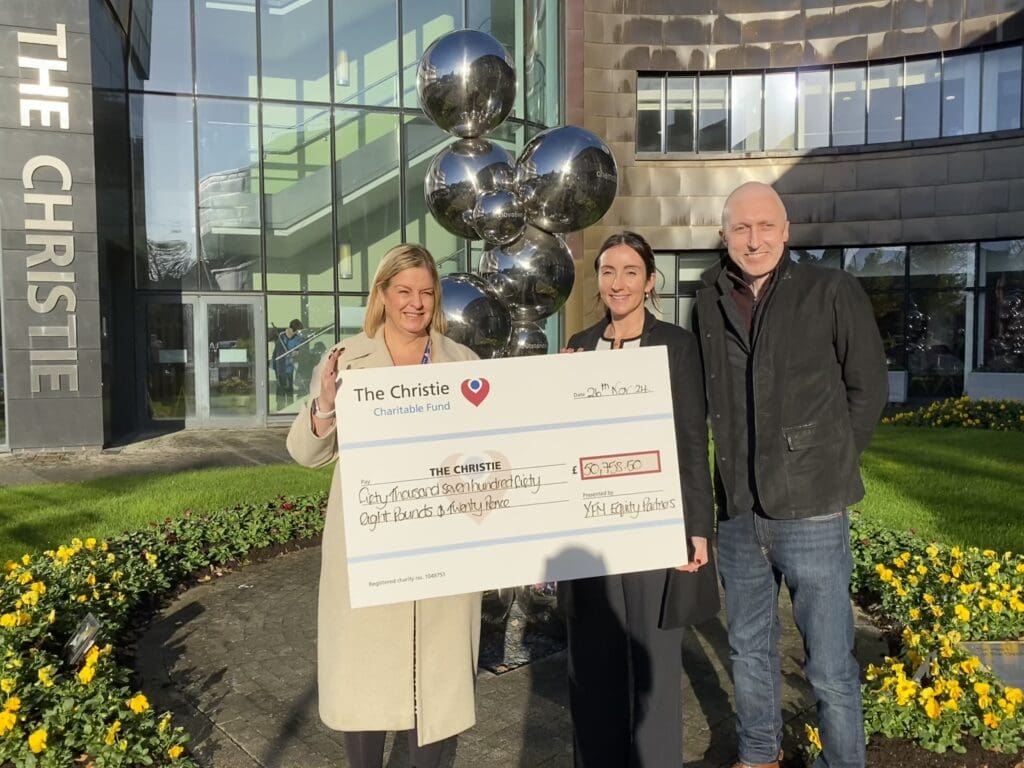

YFM Equity Partners has successfully closed the fundraising for its British Smaller Companies Venture Capital Trusts (VCTs), securing an impressive £75 million in just 11 weeks.

At YFM Equity Partners, we are passionate about backing UK SMEs, and our success is driven by the dedication of our team.