Investing in Growth: Backing DynaRisk to Transform Cyber Insurance

Empowering the Insurance Industry with Smarter Cyber Risk Management

At YFM, we back businesses that are solving urgent, complex problems with innovative technology—and scaling fast while doing it. That’s why we’re excited to announce our latest investment: $4.7 million of growth capital into DynaRisk, a London-based cyber intelligence SaaS company helping insurers and their policyholders better manage and mitigate the rising threat of cybercrime.

With cyber risk now a top concern for consumers and SMEs, the insurance sector is under pressure to offer more meaningful digital protection. DynaRisk is stepping up to meet that demand with a powerful suite of embedded solutions already trusted by major insurers including Hiscox, Chubb, Gallagher, and Beazley.

A Sector Under Siege

The cyber insurance market is growing rapidly—but so are the threats. From phishing and ransomware to dark web data breaches, digital risks are increasing in frequency and sophistication. For brokers, MGAs and underwriters, traditional tools are no longer enough to meet policyholder expectations—or manage claims costs.

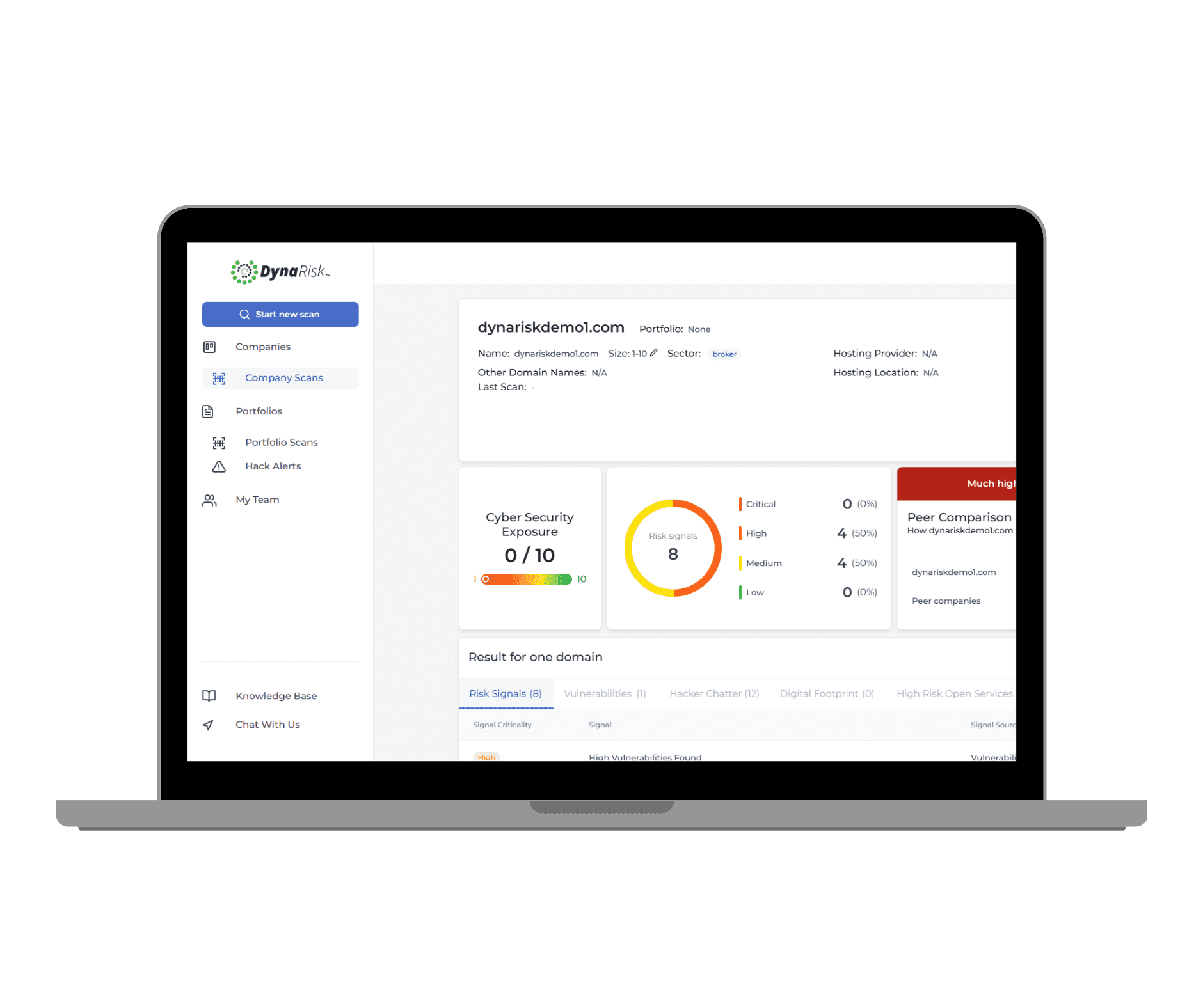

That’s where DynaRisk comes in. Its platform combines cyber risk scoring, vulnerability scanning, dark web monitoring, and multilingual 24/7 support, giving insurers a smarter, proactive way to protect individuals, families and SMEs. Often embedded directly into insurance products, these tools help reduce loss ratios, increase customer engagement and improve underwriting decisions.

With over 25 insurance customers and coverage being extended to around 2.4 million consumers and 800,000 SMEs, DynaRisk is already making a serious impact.

Backing a Business Built for Scale

Founded in 2016 by ex-banking cybersecurity lead and self-taught hacker Andrew Martin, DynaRisk was created to bring enterprise-level digital protection to the wider market. What began as a vision to simplify cybersecurity for everyday users has evolved into a market-leading platform serving global insurers across EMEA, the Americas, and APAC.

The business has grown impressively with limited outside capital and has now brought on board serial InsurTech entrepreneur Phil Zeidler to chair the board—marking a new chapter in its growth journey. Our $4.7m investment will support expansion across international markets and accelerate product innovation to meet rising demand.

Why YFM Invested

We invest in companies with clear commercial traction, a compelling vision, and a team capable of delivering it. DynaRisk stood out for its strong technology platform, high-quality client base, and deep understanding of the evolving needs of the insurance sector.

The business is tackling a major global issue with a proven, scalable solution—and doing it in a way that delivers measurable value for its customers. As embedded insurance and cyber protection become increasingly mainstream, DynaRisk is well placed to lead the market.

Strategic Support for a High-Growth Future

YFM brings more than just funding. From board development and go-to-market strategy to international expansion, we support our portfolio companies at every step. For DynaRisk, we’ll be working closely with the team as they scale operations, enhance the platform, and continue to build out their international footprint.

Cyber Protection for the Real World

Cybersecurity can be complex—but protecting people doesn’t have to be. DynaRisk is helping the insurance industry offer real protection to real people, in a way that’s scalable, effective and futureproof. That’s why we’re proud to back their mission—and excited to be part of their journey.