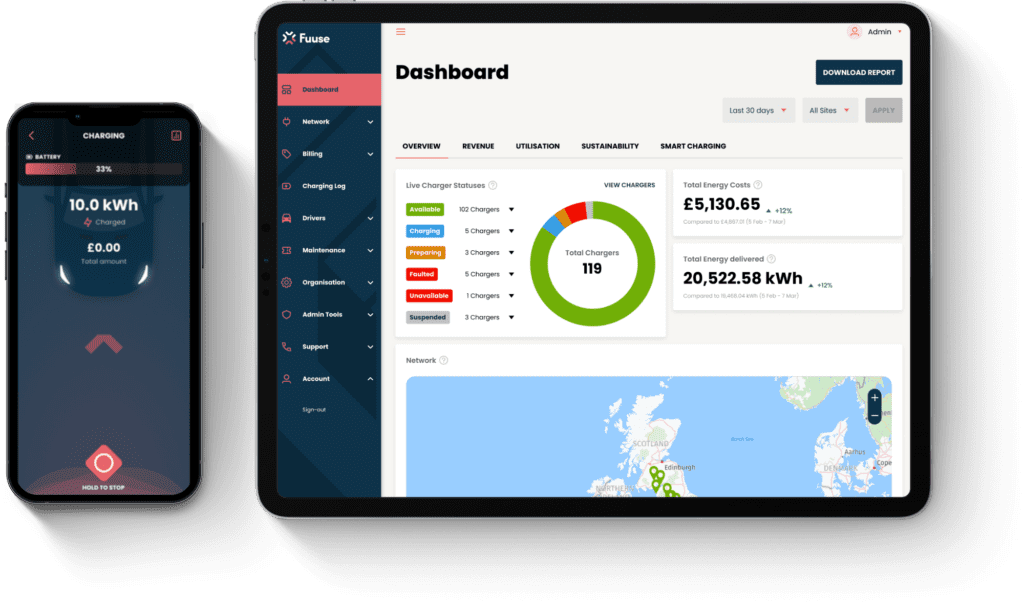

As the shift to electric vehicles (EVs) gains momentum, the need for intelligent and efficient charging infrastructure has never been greater. Fuuse, a pioneer in charge point management software, is revolutionising EV charging by enhancing accessibility, optimising energy use, and supporting the seamless adoption of sustainable transport solutions.

ESG News

Read about the latest ESG initiatives from our portfolio. Whilst YFM are not impact investors, we recognise our duty to grow businesses responsibly.

Find out how Think Hire formed strategic partnerships to power economically viable and environmentally responsible growth.

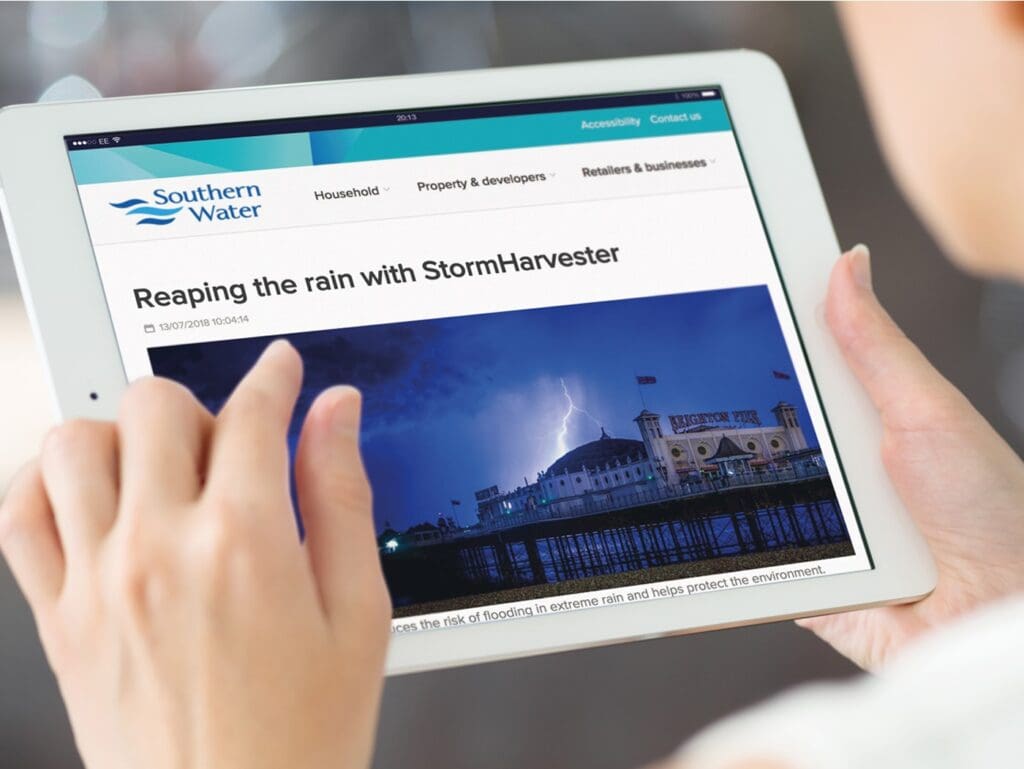

StormHarvester, a Belfast-based AI-driven SaaS company, is transforming wastewater management with cutting-edge technology that enhances efficiency while delivering significant ESG benefits. As part of YFM Equity Partners’ ESG-focused portfolio, it exemplifies how innovation drives positive environmental and social impact in critical infrastructure.