YFM provided a £3 million growth capital investment in Integrum ESG, a technology-driven platform delivering real-time ESG data insights, supporting its expansion and innovation in the evolving sustainability sector.

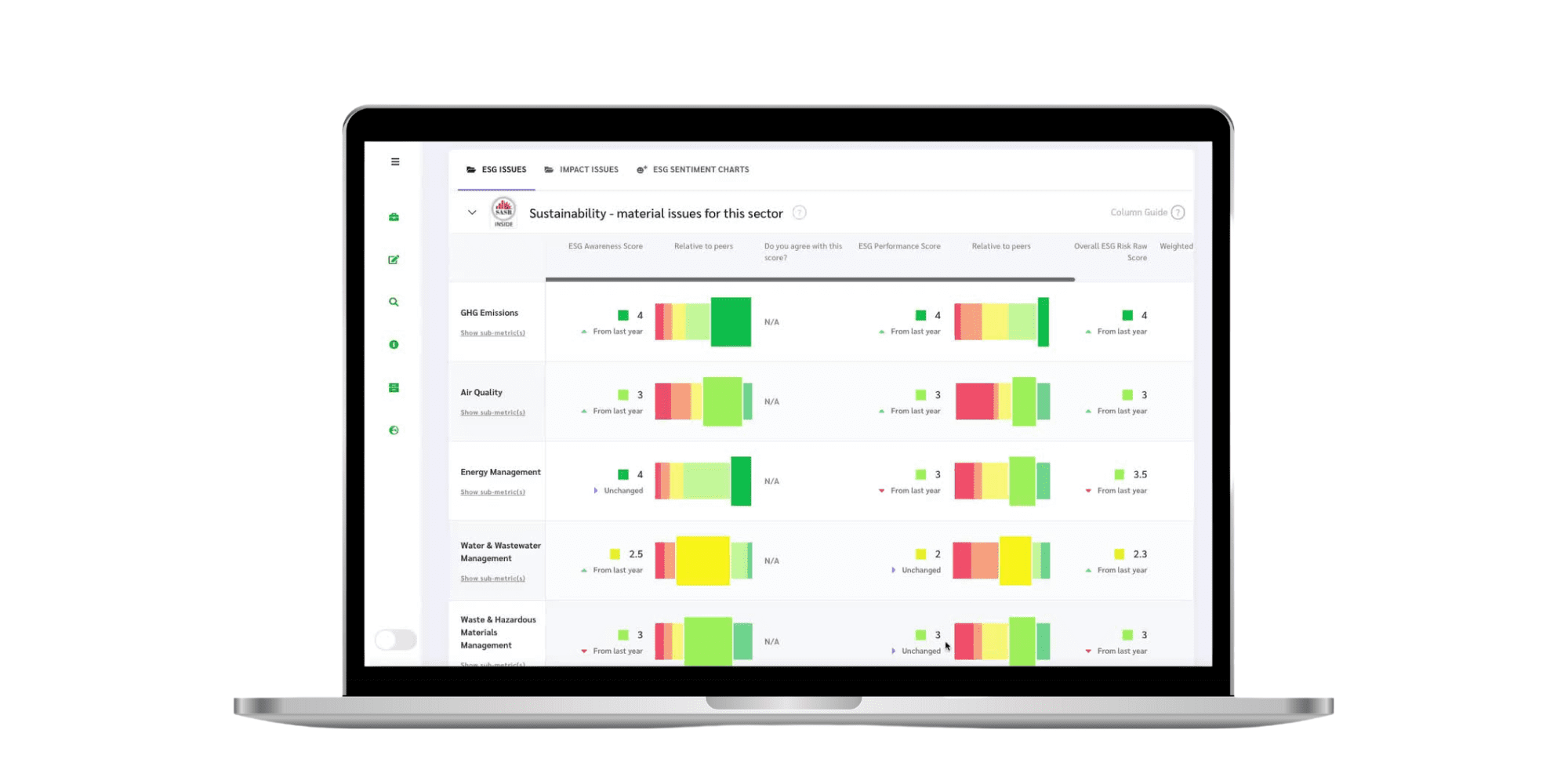

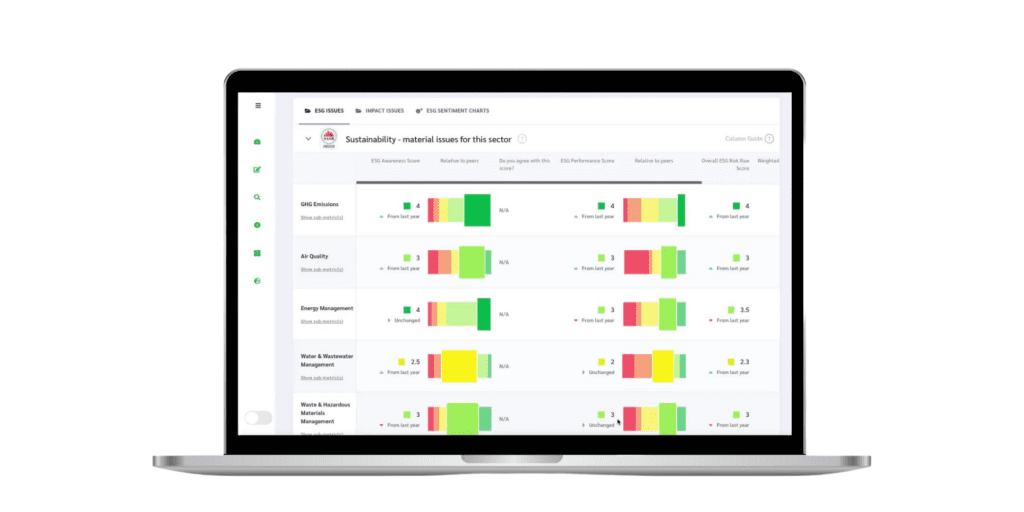

Integrum ESG is a pioneering data and analytics platform that supports investors in integrating Environmental, Social, and Governance (ESG) considerations into their decision-making processes. Based in London, Integrum ESG combines cutting-edge AI technology with deep sustainability expertise to provide actionable insights, enabling investors to identify risks, opportunities, performance against relevant benchmarks and even real time market sentiment across their portfolios.

The platform’s data-driven approach empowers institutional investors to meet growing regulatory requirements, respond to stakeholder expectations, and drive positive environmental and social outcomes while delivering competitive financial returns.